Hello

My father in law is currently being assessed under a section 2 order, and at some point we expect him to be released and he will need to go to a care home.

Assuming that we end up paying his financial status will be taken into consideration. At the moment that would include 50% of the house he owns with his wife. His wife still lives there so my understanding is that they can't touch that whilst she is still living there.

However, we would like to move Mum to nearer us, and find a home for dad in our area so it makes visiting and care for both easier, mum is in her 80s. But to do this we would want to sell their current house and buy a new one.

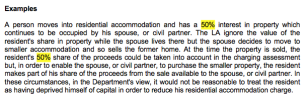

If we do to will his 50% still be available to us? Or will the LA consider it fair game to fund his care accommodation costs. I have power of attorney so can act on his behalf so I should be able to sell his house and then buy a new one in his name with no problem. But I am worried about what the LA will say in relation to how it affects his means testing.

Any advice.

My father in law is currently being assessed under a section 2 order, and at some point we expect him to be released and he will need to go to a care home.

Assuming that we end up paying his financial status will be taken into consideration. At the moment that would include 50% of the house he owns with his wife. His wife still lives there so my understanding is that they can't touch that whilst she is still living there.

However, we would like to move Mum to nearer us, and find a home for dad in our area so it makes visiting and care for both easier, mum is in her 80s. But to do this we would want to sell their current house and buy a new one.

If we do to will his 50% still be available to us? Or will the LA consider it fair game to fund his care accommodation costs. I have power of attorney so can act on his behalf so I should be able to sell his house and then buy a new one in his name with no problem. But I am worried about what the LA will say in relation to how it affects his means testing.

Any advice.